The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well.

By using encryption, access rules, & tools for spotting violators, it stops unauthorized access & data breaches, which guarantees safe wireless connections for both personal & business use in the connected world. Businesses are increasingly adopting advanced solutions such as network access control and wireless threat prevention to strengthen enterprise wireless protection.

Wireless network security is a critical focus in 2024, driven by the rise of IoT, 5G, and remote work. Conferences like RSA and Black Hat spotlight trends such as AI-driven threat detection, Zero Trust architectures, and advanced encryption methods.

Statistics show wireless attacks growing by 25% annually, emphasizing the need for robust solutions.

Opportunities abound in sectors like healthcare and smart cities, where secure connectivity is vital. Emerging trends include quantum-resistant algorithms and decentralized security models.

Businesses prioritizing wireless security can gain a competitive edge, safeguarding operations while capitalizing on innovations in a rapidly evolving digital landscape. Additionally, organizations are leveraging

Security as a Service and

Cybersecurity Consulting Services to enhance wireless protection strategies.

Market Dynamic

The wireless network security market is growing from the growth in mobile workforces & the large adoption of Bring Your Own Devices (BYOD) policies. These security solutions allow enterprises to protect sensitive data on mobile devices & promote secure wireless connection among employees.

Moreover, organizations are constantly adopting various wireless network security measures like firewalls, identity and access management (IAM), intrusion prevention/detection systems (IPS/IDS), data loss prevention (DLP), encryption, and unified threat solutions (UTS). This combined effort to secure digital infrastructure is driving opportunities for the wireless network security market.

However, the adoption of wireless

network security solutions might face challenges due to their higher initial costs, complex nature, and potential compatibility issues with many wireless networks. Implementing these solutions requires specialized expertise for diverse environments, potentially concerning small and medium-sized enterprises with additional resource demands. In response, industry players are looking to develop user-friendly, readily deployable, & easily manageable wireless network security solutions.

Research Scope and Analysis

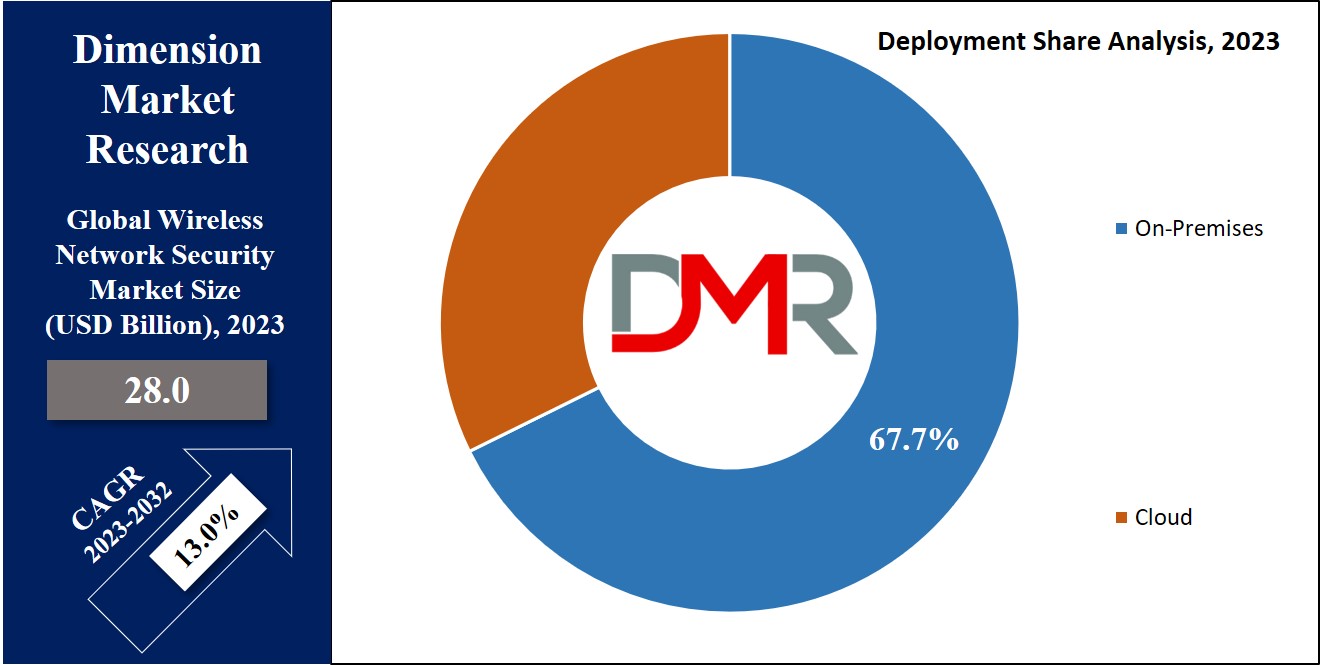

By Deployment

On-premises deployment plays a major role in driving the global wireless security market. It contributed significantly towards the overall revenue of the global market in 2023, as wireless network security requires implementing security measures directly within an organization's physical premises.

This approach provides precise control & customization but demands maintenance & infrastructure investment. It's ideal for strict security & compliance needs, allowing tailored safeguards for wireless networks. Further, these trends & factors are expected to drive the market over the forecasted period.

By Type

In 2023, the firewall has a significant market share by contributing substantially to the overall revenue of the global network, as it serves as a crucial component of wireless network security. It acts as a barrier, inspecting & controlling incoming & outgoing network traffic.

By analyzing data packets, a firewall applies security policies, preventing unauthorized access & potential threats from entering or exiting the wireless network. This safeguard helps protect sensitive data, devices, & systems, allowing a resilient & safe wireless network environment. As the world leads towards digitalization, the firewall is anticipated to drive the global network security market in the coming future as well.

By Organization Size

In 2023, large enterprises drive the global wireless network security market, as they implement wireless network security to improve their digital infrastructure. This involves strong authentication, encryption, & intrusion detection ensuring data safety, preventing unauthorized access, and countering cyber threats. This security measure is important for seamless operations, protecting critical data, & meeting industry regulations. It is anticipated that they will drive the market growth in the coming future as well.

By End User Industry

The government sector is one of the major sectors driving the global wireless network security market in 2023 and is anticipated to do so throughout the forecasted period, as wireless network security plays a major role in government operations, as it allows secure communication, data protection, & access control within government agencies.

By installing encryption, authentication, & intrusion detection systems, governments safeguard sensitive information, critical infrastructure, & citizen data from cyber threats. This proactive approach strengthens national security, maintains public trust, & allows for efficient and secure digital governance.

The Global Wireless Network Security Market Report is segmented on the basis of the following

By Deployment

By Type

- Firewall

- IPS/IDS

- Encryption

- Identify and Access Management

- Unified Threat Management

- Others

By Organization Size

By End User Industry

- BFSI

- Government

- Healthcare

- Retail

- Aerospace & Defense

- IT & Telecom

- Manufacturing

- Others

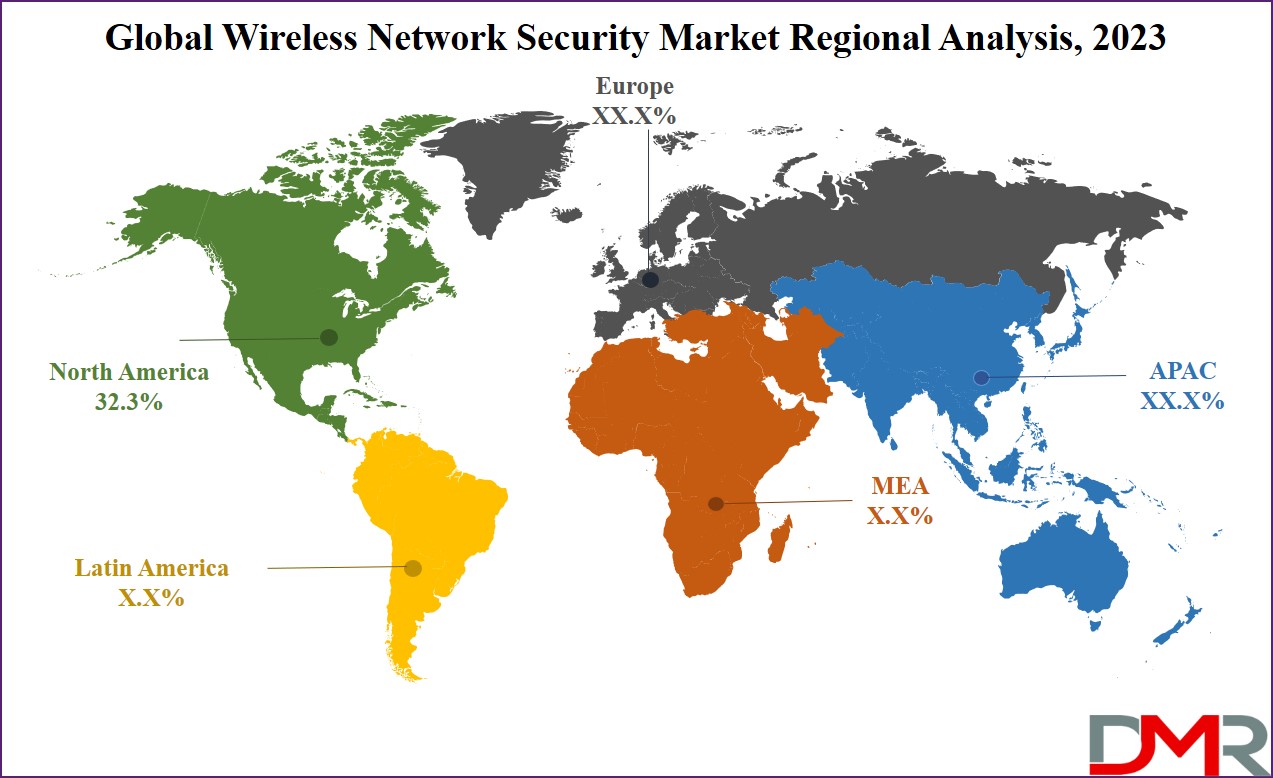

Regional Analysis

In 2023, the North American region secures a significant market share,

accounting for over 32.3% of the total revenue for the global wireless network security market. The wireless network security market in North America is being driven by factors like the expanding adoption of the BYOD concept, growing security breaches, and the strong presence of established market players such as Dell Technologies Inc., Cisco Systems, Inc., Fortinet, Inc., and IBM Corporation.

Furthermore, numerous companies across sectors like BFSI, retail, & healthcare are making significant investments in cybersecurity to safeguard their enterprise data from advancing digital threats. These factors further create a favorable setting for the expansion of the wireless network security market during the forecasted period.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The wireless network security market is quite fragmented, which makes the market players look for mergers & acquisitions for product portfolio enhancement. In addition, these market players constantly upgrade their product offerings with the latest technologies to remain competitive & relevant within the industry.

For instance, in December 2022, Cradlepoint introduced its zero-trust network access (ZTNA) service within the NetCloud Exchange (NCX) platform. This launch includes offerings like Secure Connect & Advanced SD-WAN products, all integrated into the NetCloud software platform. Mainly, the platform backs wireless WAN through 4G LTE and 5G wireless edge routers.

Some of the prominent players in the Global Wireless Network Security Market are

- Cisco System

- IBM Corp.

- Dell Technologies

- Juniper Network Inc

- Fortinet Inc.

- Broadcom Inc.

- Aruba Networks (HPE)

- Honeywell International Inc.

- ADT Inc.

- Trend Micro

- Other Key Players

Recent Developments

- September 2025: SPTel launched AI-Security, an AI-powered cybersecurity tool designed to help SMEs quickly identify and assess cyber risks cost-effectively.

- August 2025: SonicWall unveiled a lineup of nine new Generation 8 firewalls, incorporating Zero Trust Network Access (ZTNA), cloud-native management, integrated cyber warranties, and optional co-managed security services—aimed at MSPs and MSSPs for robust wireless and network security.

- June 2025: Netgear acquired Bengaluru-based cybersecurity startup Exium, enhancing its managed-service and secure networking offerings tailored for MSPs and enterprise clients.

- July 2025: Mobile Communications America (MCA) acquired Wireless Concepts International, expanding its in-building wireless engineering capabilities across the Midwest, including Wi-Fi, small cell, public-safety, and DAS

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 28.0 Bn |

| Forecast Value (2032) |

USD 83.9 Bn |

| CAGR (2023-2032) |

13.0% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Deployment (On-Premises and Cloud), By Type (Firewall, IPS/IDS, Encryption, Identify and Access Management, Unified Threat Management and Others), By Organization Size (SMEs and Large Enterprise), By End User Industry (BFSI, Government, Healthcare, Retail, Aerospace & Defense, IT & Telecom, Manufacturing and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Cisco System, IBM Corp., Dell Technologies, Juniper Network Inc, Fortinet Inc., Broadcom Inc., Aruba Networks (HPE), Honeywell International Inc., ADT Inc., Trend Micro, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |